Become a Sponsor

If you are considering becoming a financial supporter of APA, please do give us a call so we may explain the process and benefits. Because APA is a non-profit entity, contributions may be tax deductible. What better way to insure the continuance of quality upscale entertainment and promote the performing arts than to be a supporter of APA.

For additional information about sponsorship, please contact us at 803-643-4774.

Become a Contributor

Aiken Performing Arts Group, Inc. (APA) is a non-profit presenting organization whose main business is presenting touring professional artists to the public; in our case, in the Central Savannah River Area (CSRA). Like other similar groups throughout the United States, ticket revenues do not cover all the expenses of our presentations, student workshops, and receptions.

We must rely on a combination of ticket sales and contributions from people who believe that what we are doing adds to the quality of life here in the CSRA. Once our operating costs are covered, the majority of contributed dollars are directed to broadening our educational outreach activities, expanding our shows, and upgrading the talent we bring to you.

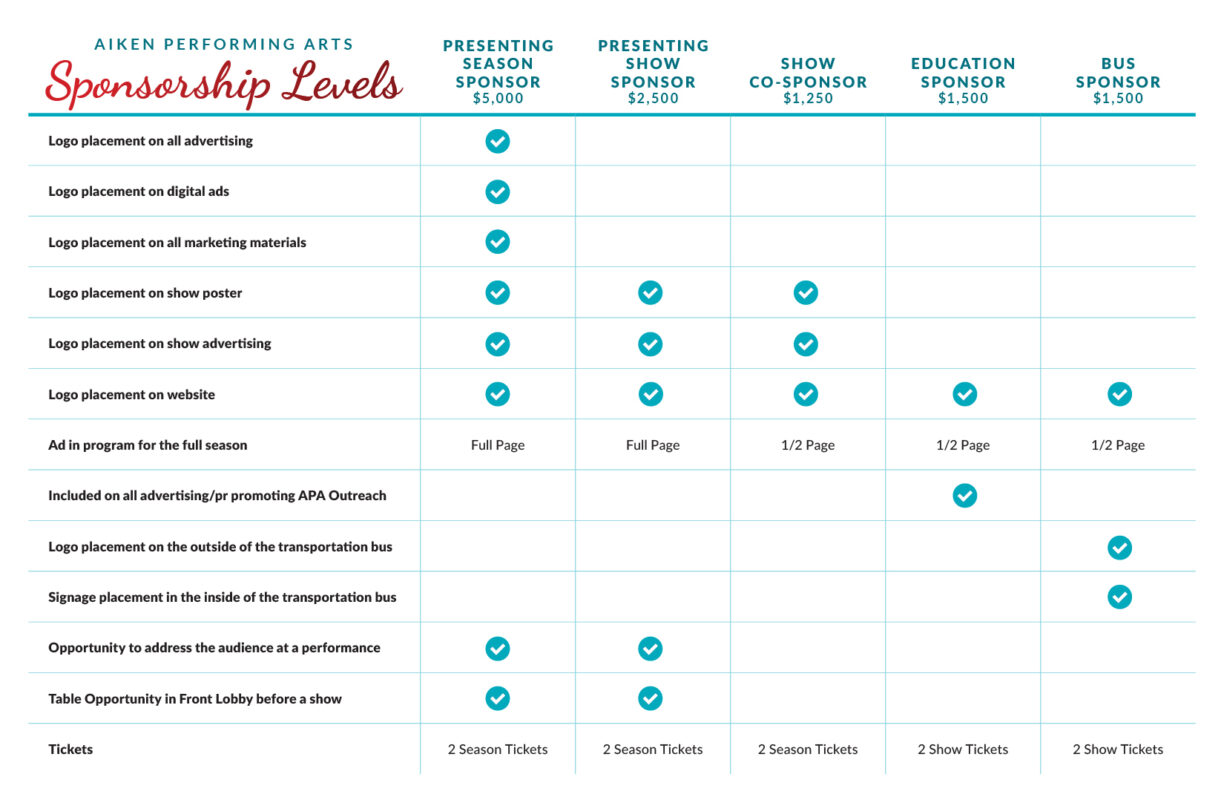

To assist APA in its efforts to attract supporting funds, we have developed several levels of suggested giving. While each level provides attractive benefits, the important thing is that the dollars generated go directly to improvements in the entertainment we offer. Please consider making a gift to support us in our effort to bring the finest professional artists to Aiken.

For additional information about becoming a contributor, please contact us at 803-643-4774.

Contributor options

PRINCIPAL SPONSOR ($2,500 or above)

This level of sponsorship provides benefits including advertising and promotional credit.

Director

($500 per person)

Stage Manager

($250 per person)

Patron

($100 per person)

FRIEND

(Under $100 per person)

Aiken Performing Arts Group is a 501 (c)3 tax exempt organization. Gifts to APAG are considered exempt from taxation under Federal and State law. Please consult your tax advisor concerning this and other contributions.